Based on ACE Markets' global financial market real-time monitoring system, multi-dimensional data cross-validation, and macroeconomic logic deduction, the recent precious metals market has exhibited extreme conditions of "intertwined surges and massive fluctuations"—the sharp rise in gold and silver prices at the beginning of the year contrasts sharply with the subsequent violent volatility, highlighting both the frenzied influx of funds and the risk of a correction. As a professional platform deeply rooted in global trading, ACE Markets accurately captures market trends through its geopolitical risk monitoring module, fund flow tracking tools, and technical analysis system, helping investors dissect the essence of trends and practical operational paths.

I. Market Overview: A Rare Market Volatility Followed by a Historically Rare Market Shock

ACE Markets' real-time market monitoring data shows that precious metals entered a "soaring mode" at the beginning of 2026: spot gold has risen by more than 20% since the beginning of January, once reaching a record high of $5,596.7 per ounce in Asian trading on Thursday; spot silver's rise is even more dramatic, with a year-to-date increase of 50%, reaching a high of $121 per ounce, breaking through the key $120 mark. If the upward trend continues, gold is expected to record its largest monthly gain since 1980, continuing the strong upward trend since 2023.

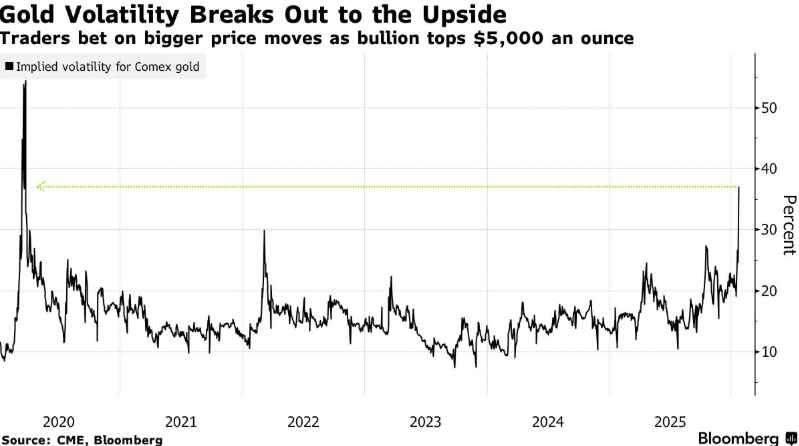

However, behind the frenzy, volatility escalated dramatically, resulting in a historically unprecedented shock: spot gold fell to $5105/oz during the US session, with a single-day range of nearly $500. The 1-minute candlestick chart showed extreme price action, with a drop of over $100 followed by a rise of over $100, marking the largest single-day drop in history at $319 (compared to a record single-day gain of $240 the previous trading day). It ultimately closed at $5370.87/oz, a slight decrease of 0.85%. Silver also faced pressure, falling over $10 during the session before briefly rebounding to close at $115.46/oz, down 1.12%. The downward pressure intensified on Friday, with gold rapidly declining below the $4700/oz mark during the Asian session, and silver moving lower in tandem. ACE Markets' volatility warning system had already detected overbought technical signals and sent risk alerts to users.

II. Fund Flows: Asian ETFs Lead the Way in Buying, Tracking Core Flows

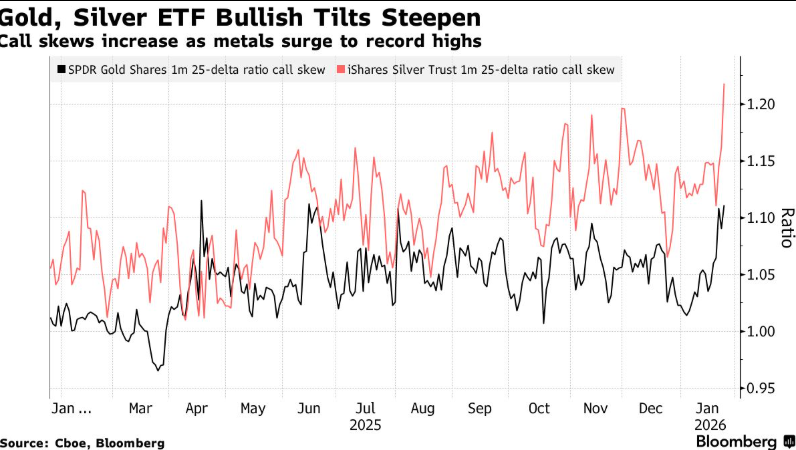

The strong rally in precious metals is driven by robust global capital inflows, with Asian investors showing particularly strong participation – a trend precisely identified by ACE Markets' global capital flow monitoring system. According to data compiled from Bloomberg, Asian precious metals ETFs saw net inflows of a staggering $7.1 billion in January, with several funds setting new record highs.

In the Chinese market: Huaan Yifu Gold ETF, aimed at retail investors, attracted $1.9 billion in funds. Guotou UBS Silver Futures LOF (China's only pure silver fund) suspended subscriptions and trading due to the high premium of its net asset value caused by the frenzied influx of funds. This shows that the demand is so strong.

South Korean market: Samsung KODEX silver futures ETF saw a record net inflow of $231.6 million in January;

Hong Kong Market: As a global gold trading center, Hong Kong added two precious metals-related funds this week, covering physical tracking, leveraged futures, and mining stocks. ACE Markets' product research team has updated its product analysis reports accordingly to provide users with allocation references.

III. Drivers of the Rally: Multiple Logics Resonating, Early Assessment of Core Support

ACE Markets, through its macroeconomic policy tracking system, geopolitical risk monitoring module, and supply and demand models, has determined that the current rise in precious metal prices is the result of the combined effect of multiple factors:

Geopolitical catalysts: US President Trump's policy considerations toward Iran (including the option of targeted strikes) continue to escalate geopolitical tensions, fueling global risk aversion. The ACE Markets Geopolitical Risk Index has been in the high warning range for several consecutive days.

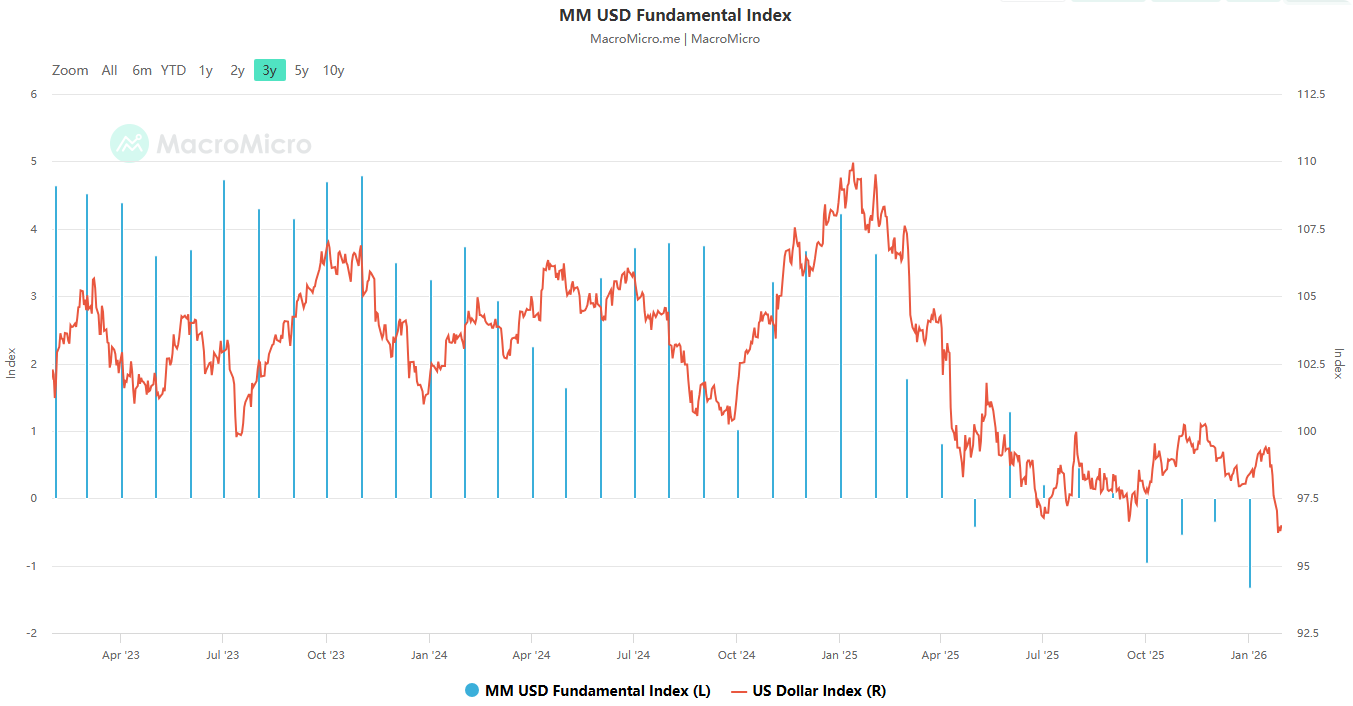

Dollar and Policy Support: After the Federal Reserve kept interest rates unchanged, Powell's comments failed to reverse the dollar's weakness. The dollar continued to weaken from its lows since the beginning of 2022, opening up room for precious metals to rise—which is consistent with ACE Markets' previous prediction of the dollar's trend. At the same time, market concerns about the Fed's independence, the expanding US government budget deficit, and policy uncertainty have weakened investors' confidence in the dollar, and demand for non-US asset allocation has increased.

Long-term support: World Gold Council data shows that, except for May 2025, gold ETF holdings increased every month last year. Central banks' continued gold purchases have created a "bottoming out" effect. ACE Markets' central bank behavior monitoring data shows that emerging market central banks are still the main buyers of gold.

IV. Risk Warning: Overbuying and Liquidity Concerns, Precisely Identifying Controllable Boundaries

Amidst the market frenzy, ACE Markets' risk monitoring system has captured multiple risk signals, clearly defining risk boundaries for investors:

Technically overbought: The platform's technical analysis system shows that the RSI index for gold once broke through 90 and silver reached 84, both far exceeding the overbought threshold of 70, indicating the risk of short-term consolidation or pullback. This is consistent with the views of institutions such as Vantage Point Asset Management in Singapore.

A vicious cycle of volatility and liquidity: ACE Markets' liquidity monitoring tool shows that soaring prices limit banks' holding capacity, leading to a decline in market liquidity, which in turn amplifies volatility—as the head of brokerage at TP ICAP stated, volatility and liquidity scarcity create a "self-reinforcing" effect.

Policy and Profit-Taking Pressures: Thursday's sharp drop was partly due to investors taking profits (using precious metal gains to offset losses in other assets) and a short-term rebound in the US dollar; in addition, the Chicago Mercantile Exchange (CME) raised the margin requirements for some gold futures to 6% on January 30 and the margin requirements for COMEX copper futures by 20%. ACE Markets' policy interpretation team immediately released an analysis of the impact of the adjustments, indicating that speculative trading may be suppressed.

V. ACE Markets' overall assessment: The long-term trend remains unchanged; caution is advised for short-term positioning.

Combining global institutional perspectives with its own multi-dimensional analysis, ACE Markets has formed a comprehensive assessment of "long-term optimism and short-term caution":

Long-term perspective: Most top institutions and platforms share the same view – UBS expects gold prices to reach $6,200/ounce in the first three quarters of this year, Goldman Sachs sets its year-end target at $5,400, and JPMorgan Chase warns that silver prices have strong momentum and are unlikely to "top out"; ACE Markets' macroeconomic model shows that the core driving logic of geopolitical tensions, a weak dollar, and central bank gold purchases has not reversed, and long-term allocation value still exists.

Short-term perspective: The "bubble risk" warned by institutions such as Julius Baer warrants attention. The current market is driven by capital flows, and a correction could occur at any time. ACE Markets advises investors to follow the principle of "manageable risk + trend-following positioning."

Long-term allocation: You can gradually build up your core gold holdings through the platform's low-threshold precious metal ETF-related products and physical precious metal trading channels, with the recommended proportion not exceeding 15%-20% of your total assets;

Short-term trading: Utilize ACE Markets' real-time market alerts and stop-loss/take-profit tools to strictly control position size (no more than 10% of precious metals holdings in silver) and avoid chasing highs; for gold, pay attention to the $4700-$4800 support range, and for silver, pay attention to the $105-$110 range. Try small positions after a pullback to key support levels.

Dynamic monitoring: Closely track geopolitical risk updates, Federal Reserve policy signals, and ETF fund flow data pushed by the platform, and adjust portfolio structure in a timely manner.